MetaTrader vs Match-Trader; A Comparison

Written by Rachel on September 22, 2025.Picking the Right Trading Platform: MetaTrader vs Match-Trader

Picking the right trading platform is like choosing the right pair of shoes for a marathon. The wrong one slows you down, hurts your performance, and worse – makes you lose. In this MetaTrader vs Match-Trader comparison, we’ll show how a clunky, outdated, or incompatible platform can throw off your timing, delay execution, or make simple tasks frustrating. In a space where milliseconds and clarity matter, that’s a risk you simply can’t afford.

That’s why today we’re breaking down two of the most talked-about trading platforms: MetaTrader (MT4 & MT5) and Match-Trader.

In This Article, We Will Cover:

- What MetaTrader and Match-Trader are and who they are built for

- A direct feature-by-feature comparison of MetaTrader vs Match-Trader

- The unique strengths that set each platform apart

- A final verdict on which platform is right for your trading goal

Who Are These Platforms Really For?

MetaTrader:

MetaTrader was first launched in 2005 as MT4 and later upgraded in 2010 as MT5. It was originally built for retail traders but quickly became popular with professional traders and brokers around the world. Over time, it became the go-to platform for:

- Traders who rely on indicators and technical tools

- Anyone building or using automated strategies (Expert Advisors)

- Forex-focused traders, especially scalpers and day traders

- Traders who want deep chart control

Match-Trader:

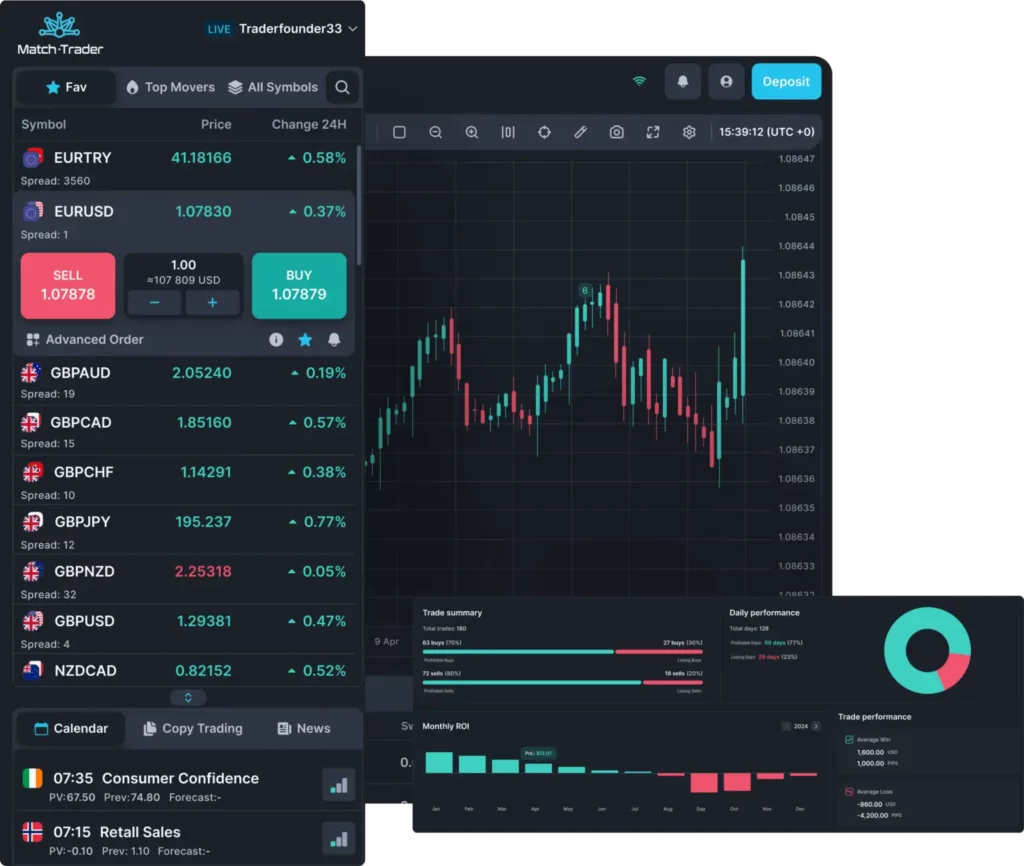

Match-Trader is a browser-based platform built specifically for modern trading needs, especially within the prop firm ecosystem. It’s fast and built for convenience. It quickly became a favorite among:

- Prop traders going through challenges and funded phases

- Traders who prefer not to download software

- Brokers looking for CRM-ready platforms

- Traders who rely on copy trading tools

MetaTrader vs Match-Trader: Detailed Comparison

Let’s break down both platforms, feature by feature, so you can see which one fits your trading style best.

User Interface

A user interface (UI) is what you see and interact with when using a trading platform. It’s the layout, buttons, menus, charts, and overall design.

- MetaTrader: MetaTrader is functional but less visual. Stop loss and take profit levels require manual calculation, which can slow things down.

- Match-Trader: Match-Trader is designed with flow in mind. The interface is modern, web-first, and works across all devices. Tools like stop loss and take profit automatically display monetary values, so decision-making is faster and cleaner.

🏆 Winner: Match-Trader

MetaTrader vs Match-Trader: Automation & Algorithmic Trading

Algorithmic trading allows software to place and manage trades 24/7.

- MetaTrader: MetaTrader dominates here, with full support for Expert Advisors (EAs). Traders can write scripts in MQL, backtest strategies, and deploy bots on live accounts.

- Match-Trader: Supports limited scripting for simple automation but isn’t robust enough for advanced bot traders.

🏆 Winner: MetaTrader

Mobile Trading Experience

- MetaTrader: Has dedicated apps for iOS and Android but requires downloading and credentials.

- Match-Trader: Mobile-responsive by default, works on any browser, and adapts to mobile screens smoothly.

🏆 Winner: Match-Trader

MetaTrader vs Match-Trader: Charting & Technical Analysis

Charting tools are what traders use to analyze the market. This includes everything from candlestick charts and timeframes to indicators and drawing tools. A platform with strong charting tools helps traders break down price action, spot patterns, test strategies, and plan entries and exits.

- MetaTrader: Supports multi-chart layouts, custom indicators, full scripting options, and precise visual control – perfect for technical analysis.

- Match-Trader: Supports major indicators, standard drawing tools, and smooth chart navigation.

🏆 Winner: MetaTrader

Copy Trading & Signals

Copy trading allows one trader to automatically mirror the trades of another.

- MetaTrader: Supports copy trading via MQL5 Signals or broker plugins, which adds extra steps.

- Match-Trader: Native copy trading built in, no extra tools needed.

🏆 Winner: Match-Trader

MetaTrader vs Match-Trader: Prop Trading Support

Prop trading support refers to how well the platform meets the specific needs of prop traders – like challenge tracking, account growth metrics, risk limits, and evaluations. A good prop trading platform helps traders stay within rules and hit targets without needing multiple external dashboards.

- MetaTrader: Can be used for prop trading but requires external dashboards or custom solutions.

- Match-Trader: Built with prop firms in mind, includes dashboards for challenge tracking, rule violations, lot sizes, and real-time analytics.

🏆 Winner: Match-Trader

Unique Strengths They Don’t Share

| Only MetaTrader Offers: | Only Match-Trader Offers: |

| Full EA support | Browser-based, no download needed |

| Decades of community support | Native copy trading |

| Deep marketplace of indicators and strategies | Built-in prop trading dashboards |

| Offline desktop trading | Seamless CRM integration for firms and brokers |

Final Verdict: MetaTrader vs Match-Trade

Maven supports both platforms, so the choice depends on your trading style. In this MetaTrader vs Match-Trader comparison, we’ve highlighted each platform’s strengths. Experienced traders may stick with MetaTrader, while modern prop firm traders often find Match-Trader smoother and more beginner-friendly. Ultimately, your goals will determine which platform in the MetaTrader vs Match-Trader debate is right for you.

Want to know how these two platforms compare to cTrader? Compare MT5 to cTrader, Match-Trader to cTrader, or compare them all.