Daily vs Max Drawdown Rules: Prop Firm Risk Explained

Written by Jon on January 15, 2026.Introduction

Traders must understand daily vs max drawdown rules to succeed in prop trading. Many traders fail not because they lack skill, but because they are unfamiliar with these essential risk limits that protect both the trader and the firm. Knowing how these rules work and how to manage your trades around them is a key factor in becoming consistently profitable. In this blog we’ll cover:

- What is drawdown?

- What is daily drawdown?

- What is maximum drawdown?

- Strategies to navigate drawdown.

What Are Daily vs Max Drawdown Rules?

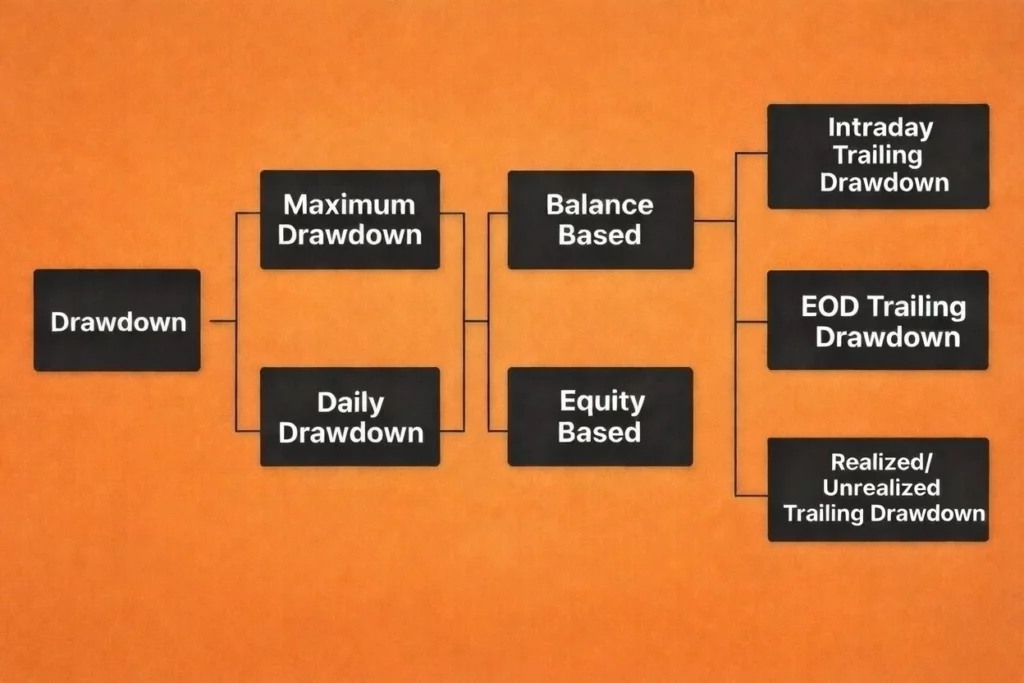

Drawdown is a measure of how much your trading account falls from its peak. Prop firms use daily vs max drawdown rules to limit risk and ensure traders manage their capital responsibly. These rules act as guardrails, preventing excessive losses while promoting consistent trading behaviour.

| Drawdown % = Peak Equity – Current Equity 100 |

N.B.: Peak equity refers to the highest balance (or equity) reached by the account, and current equity refers to the present balance (or equity). You can think about it like a mountain top and a valley. If you bought a $10,000 account and on your first trade made $300, your peak equity is $10,300. If you then go ahead to lose $400 over the next couple of trades, your current equity is $9,900. So, you’re in a $400 drawdown or a 4% drawdown.

Prop firms have drawdown rules to act as constraints for traders, giving them a budget that, if exhausted, leads to the loss of the account. This curbs greed and inconsistent behaviour in traders and also protects the capital of the prop firms. To understand how these rules shape your performance, let’s look at the two major types of drawdown rules in prop trading.

Understanding Daily Drawdown Rules in Prop Firms

Daily drawdown, also called the daily loss limit, is the maximum loss you can take in one trading day. Exceeding this limit usually results in losing access to your account.

This daily limit can be balance-based, meaning your starting balance at the beginning of the day determines your daily drawdown limit. Or it can be equity-based, meaning the starting balance plus the floating profit or loss determines the daily drawdown limit. This is also known as trailing drawdown. Equity-based drawdown limits are usually stricter than balance-based ones because they also include floating losses, not just closed positions.

Example of Balance-based daily drawdown:

If you have a $10,000 account and your prop firm uses a 5% balance-backed drawdown system, that would mean:

- If you have a daily cumulative loss that is greater than or equal to $500 or more, you breach the rules and lose your account.

- You have to close the trade for the breach to reflect in your balance; floating losses don’t count.

- If you lose less than $500, your daily loss is reset at the start of the new day to reflect your starting balance until you hit the Max Drawdown limit.

Example of Equity-based drawdown limit:

If you have a $10,000 account and your prop firm uses a 5% equity-backed drawdown system, that would mean

- If your equity (your balance – your floating trades) is greater than or equal to $500, you breach the rules and lose your account.

- You don’t have to close the trade to breach the rules; your floating losses count.

- If your floating loss is less than $500, your daily drawdown is reset at the start of the new day to reflect your starting balance until you hit the Max Drawdown limit. So if you entered a trade or a few trades at the same time and your position(s) go over $500 in the negative, you lose the account. If it doesn’t, your drawdown limit resets the next day.

Maximum Drawdown Rules Explained

Maximum drawdown, or total drawdown, measures the largest loss allowed from the peak of your account over its lifetime. Breaching this limit also leads to account loss.

Max drawdowns can be:

- Static / Fixed: Set at the account start relative to starting balance.

- Dynamic / Trailing: Adjusts with your account equity growth, so the dollar amount changes but the percentage remains fixed.

Knowing your prop firm’s daily vs max drawdown rules ensures you trade within limits and maintain consistent risk management.

Strategies to Navigate Daily vs Max Drawdown Rules

This in-depth study into drawdown rules and the various kinds shows one thing. The essential understanding of drawdowns and how to manage them makes all the difference in trading success (replace this sentence: it’s the exact one you started with). The purpose of drawdown rules is to keep you in check and instill the most important trait of successful trading: Risk management. Hence, a few tips for navigating a drawdown will be

- Accepting that losses are inevitable: Novice traders often think they can reach a level of skill where they never get into a drawdown, but that is wrong. Drawdowns are mathematically unavoidable, and they should be managed, not avoided.

- Understand your strategy’s win rate through backtesting, forward testing, and frequent journaling. This knowledge is important in risk allocation, and it gives you consolation when in a drawdown that you have a consistent strategy and your edge will eventually work; you just have to control your risk till it does.

- Embrace risk management: If you have a 70% win rate. That means if you win 70 trades in a sample size of 100 trades, you then should not risk 10% per trade because if you get 10 losing trades in a row, as is possible with a 70% win rate system, you blow your account. So your risk should reflect your win rate.

- Understand your prop firm’s drawdown rules: It is essential to understand the drawdown rules of any prop firm you are trading with. Are they equity-based or balance-based? What are the percentages? Can the account be reset? What are the rules around high-impact news trading? All of these are important, and they contribute to a successful trading career, regardless of the circumstances.

Conclusion

Mastering daily vs max drawdown rules is critical for consistent trading success. These rules teach risk management, discipline, and how to preserve capital, which are the hallmarks of profitable traders. Many fail not because of skill but because they don’t understand how to navigate these rules. By learning them, you stay in control, protect your account, and grow as a trader.