Trading Journal for Prop Firms: How It Helps You Get Funded

Written by Hunter on December 4, 2025.Summary

Keeping a trading journal for prop firms is one of those underrated habits that separates the almost funded from the consistently funded but some traders treat it like flossing: everyone says it’s important, but barely anyone does it. The truth is if you’re serious about getting funded and staying funded with a firm like Maven, a journal might be the game changer.

In this article, we will be discussing:

Do You Remember That Trade? Why a Trading Journal for Prop Firms Solves That Problem

Have you ever closed a trade, walked away from the chart, and five minutes later forgotten why you even entered? That’s a problem many traders face because they’re not keeping a trading journal. Most traders try to “remember” why they took a trade but that memory lasts maybe a few hours, tops. But when it’s written down, tracked, and reviewed, everything changes because you’re not just racking up trades, you are building experience.

🎥 Want to see how journaling can transform your trading mindset? Check out Louise’s video:

If you’ve failed a challenge before, there’s a high chance journaling could’ve helped you prevent it. It improves your risk management strategy, and strengthens your trading psychology under pressure.

What Is a Trading Journal for Prop Firms?

A trading journal is your logbook for every trade you take. It includes your entry and exit, the reasoning behind the trade, how you felt, how much you risked, and what the market was doing at the time. Sounds like homework, but it’s not.

Maven wants traders who trade with consistency and logic. Your journal ensures you’re thinking critically because of how effective it is as a form of feedback.

How a Trading Journal for Prop Firms Helps You Get and Stay Funded

1. It helps you improve faster

Imagine you’re trading a $50k Maven challenge and you lose three trades in a row. Without a journal, you might blame the market, the broker, or the weather. With a journal, you’ll spot the pattern like maybe you rushed every entry before news events or sized too big under pressure. Pattern spotted, mistake fixed, progress made.

2. You catch bad habits earlier

Without documenting trades, some habits can stay invisible: Maybe you revenge trade after a loss. Maybe you add to the losers. Maybe you change your lot size on every trade. These invisible habits are dangerous. A proper trading journal for prop firms helps you see what needs fixing before the account gets flagged or blown.

3. You develop better risk management

Let’s say your journal shows that every time you risk more than 1.5 percent, you lose. Boom. Now you have data to adjust. Good journaling leads to smarter risk decisions. If you want to take funding seriously, you have to take risk management seriously too and journaling is one way to stay on top of your risk management plan.

How to Start a Trading Journal for Prop Firms That Actually Works

You don’t need a $99 subscription or an app with ten tabs. A Google Sheet or notion will do. Here’s what to track:

- Date and time of trade

- Pair or instrument

- Entry, stop loss and take profit

- Why you took the trade (strategy, setup, fundamentals)

- How you felt before, during, and after

- The result

- What you learned

That’s it. Five minutes per trade.

A Quick Example

Sarah is trading a $50k Maven account based on a break-and-retest. She notes she was confident but slightly rushed. SL hits. Later in her journal, she writes the above as she noted “I entered too soon, didn’t wait for the candle to close.” The next week, she made the same mistake three times. Now she sets a rule: only enter on candle close. That’s the difference a journal makes.

There are, however, different kinds of journals, and not all of them will suit your style or your strategy. Some traders need structure and data, others need space to rant after a rough day.

What’s the Best Trading Journal for Prop Firm Traders?

The best trading journal for you is the one that you’ll actually use, consistently, honestly, and without turning it into a second job so let’s break down your options.

Traditional Journal

You’re familiar with the term ‘pen and paper journaling’ right? That’s what should be on your mind through this conversation about traditional journals. You can also picture your high school days, when you and your friends used to write in notebooks with your pens.

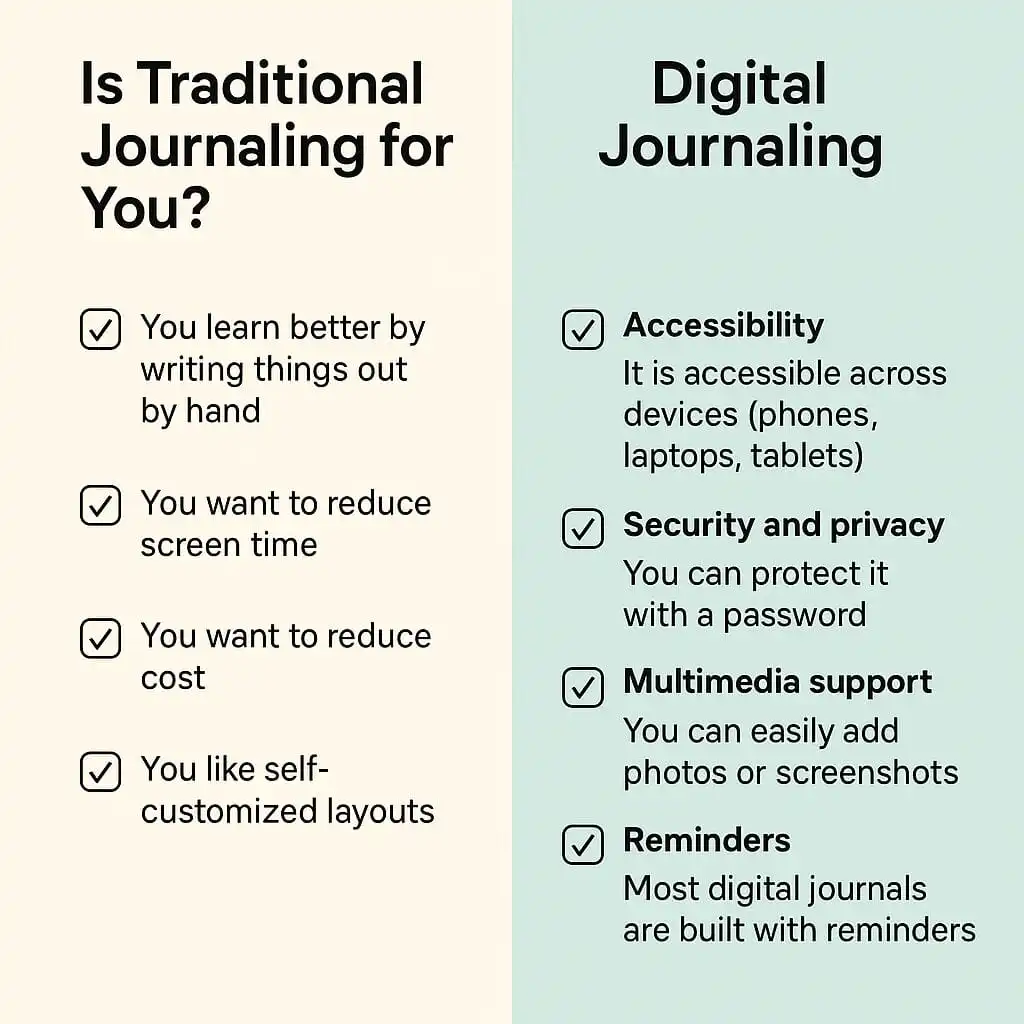

Is traditional journaling for you? Yes, it is if:

- You learn better by writing things out by hand. This helps you with emotional processing of the concepts.

- You want to reduce screen time.

- You want to reduce cost. A traditional journal basically requires you to get a notebook and a pen – this costs less than most digital journals charge.

- You like self-customized layouts, that is, you want to customize the layouts and style to appease your vision and thoughts.

Digital Journal

Did you finally get a PC before high school days ended? Or was it until you graduated? Writing those notes on it, you realise you can save them and they’ll forever be there – unlike your notebook which can be stolen or damaged by water.

How do you know if a digital journal is for you?

Choose digital journal for:

- Accessibility: it is accessible across devices (phones, laptops, tablets). Going out with your devices is easier than going with a notebook.

- Security and privacy: you can protect it with a password, thereby offering better privacy than a notebook lying around.

- Multimedia support: you can easily add photos or screenshots of your charts, videos, voice memos, links or drawings.

- Reminders: Most digital journals are built with reminders to help you build consistency.

Tick these boxes based on your preferences, whichever side scores the most is a perfect fit for you.

Remember that a good journal doesn’t just help you track your trades. It helps you track you, your mindset, your habits, your mistakes, and your growth. The right journal keeps you accountable in ways a trading plan alone can’t and in prop firm challenges, that kind of self-awareness is often what separates the funded from the frustrated.

Why Maven Cares About Your Trading Journal for Prop Firms

At Maven, we’re not just watching the results. We’re looking at your process. Trading like a pro means thinking like one. A trading journal for prop firms shows us you’re managing more than trades, you’re managing yourself.