Match-Trader vs cTrader: Which Fits Your Trading Goals?

Written by Emma on September 17, 2025.Not all trading platforms are built the same. If you’ve ever been mid-trade while your platform lags, crashes, or just feels difficult to use, you know this already. In this article, we’re comparing Match-Trader vs cTrader – two platforms traders everywhere are talking about.

Match-Trader and cTrader are two names that keep popping up in prop firms and serious trading circles but which one gives you more control?

In This Article, We Will Be Covering:

- What Match-Trader and CTrader are and whom they are built for.

- A direct feature-by-feature comparison of Matchtrader and CTrader.

- The unique strengths that set each platform (MatchTrader and CTrader) apart.

- A final verdict on which platform is right for your own trading goals.

Who Are These Platforms Really For?

Match-Trader:

It is a browser-based platform built specifically for modern trading needs, especially within the prop firm ecosystem. It’s fast and built for convenience. It quickly became a favorite among:

- Prop traders going through challenges and funded phases

- Traders who prefer not to download software

- Brokers looking for CRM-ready platforms

- Traders who rely on copy trading tools.

Match-Trader started out in 2015 as a backend tool for brokers and big financial institutions, not everyday traders. Then in 2020, the company decided to offer a version that regular traders could actually use by allowing brokers to customize and brand the platform for retail clients.

So before 2020, it was strictly for the big players. After 2020, it became something brokers could offer to individual traders.

CTrader:

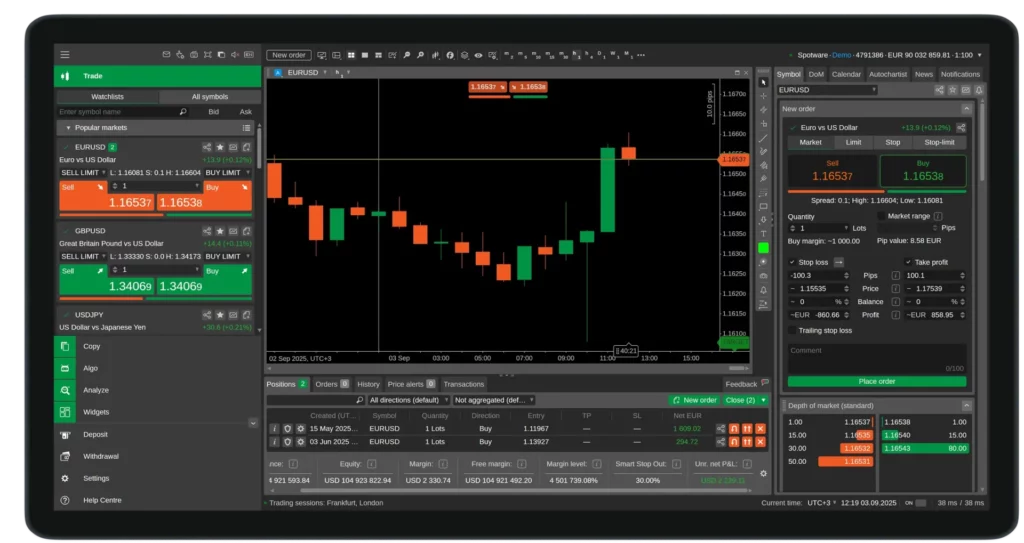

cTrader was launched in April 2011, and the first broker to offer it to traders was FxPro. What made cTrader stand out from the beginning was its clean interface, professional charting tools, and the way it connects directly to the market using ECN/DMA execution, which just means your trades go straight to the market instead of being handled by a broker who sits in the middle.

It is an advanced trading platform which became favourite among:

- Traders who prefer trading platform with advanced charting tools and analysis: it has over 70 indicators, over 28 timeframes, multiple charts type and layouts, as well as customizable templates

- Traders who prefer algorithm trading – the platform allows you customize your personal trading robots and indicators

- Traders who prefer modern and customizable user interface (UI).

Match-Trader vs cTrader: Feature-by-Feature Comparison

Let’s compare these platforms feature by feature to see which one aligns with your trading goals.

User Interface

User interface (UI) is what you interact with. It’s the buttons, menus, chart layouts, order panels, etc. It’s what makes a platform feel smooth or slow.

Example: If you can place a trade in 3 clicks, drag a stop-loss visually, and immediately see your risk in cash terms, that’s good UI. If it takes time and effort to just switch timeframes or set SL/TP, that’s bad UI.

- Match-Trader: Web-first, visual, and easy to use on any device. You can set SL/TP by dragging lines, with risk displayed in cash terms – no math required.

- cTrader: Clean, modern, customizable, and built for active traders. Orders can also be managed visually and risk-adjusted quickly.

🏆 Winner: Tie

Algorithmic Trading and Automation

Algorithmic trading means using software to place and manage trades automatically based on a set of rules or a strategy, instead of clicking buy and sell yourself.

- Match-Trader: Supports only simple automation – not ideal for advanced bots.

- cTrader: Strong automation tools with cAlgo and C# scripting for custom strategies, backtesting, and deployment.

🏆 Winner: cTrader

Mobile Trading Experience

Mobile trading experience is how smooth and easy it feels to trade directly from your phone.

It includes things like:

- How fast the platform loads

- How easy it is to place or close trades

- How clear the charts and buttons look on a small screen

- Match-Trader: Mobile-native and browser-ready – no downloads required, fully functional on the go.

- cTrader: Strong mobile app with fast performance, though it requires installation and separate logins per broker.

The only thing is, you’ll need to install the app and log in each time you change brokers. There is no download needed which means you have full access via any browser and that flexibility gives it the edge.

🏆 Winner: Match-Trader

Charting Experience

This includes using candlestick charts, switching timeframes, applying indicators like RSI or Moving Averages, and drawing tools like trendlines or zones. A strong charting setup lets you do all of that smoothly without lag.

- Match-Trader: Covers basics (trendlines, indicators, quick execution) but not designed for deep analysis.

- cTrader: Advanced multi-chart layouts, scripting, custom indicators, and precision tools.

🏆 Winner: cTrader

Copy Trading and Signal Replication

- Match-Trader: Built-in copy trading – no plugins or third-party tools required.

- cTrader: Offers copy trading as an add-on (cTrader Copy), but it’s separate from the main interface.

🏆 Winner: Match-Trader

Prop Trading Support

- Match-Trader: Designed for prop firms with built-in challenge tracking, rule monitoring, and dashboards.

- cTrader: Can be used for prop trading, but requires external tools for challenge tracking.

🏆 Winner: Match-Trader

Unique Strengths of Match-Trader vs cTrader

Here are the features each platform offers that the other doesn’t. These differences can make or break your trading experience, depending on what you need.

| Only cTrader Offers | Only Match-Trader Offers |

| Full automation with cAlgo + C# | Built-in prop firm tools and dashboards |

| Advanced scripting + backtesting | Native copy trading |

| Rich charting + custom indicators | Works in-browser with no app or download |

| Polished, professional-level interface | CRM-ready setup for brokers |

| Long-standing trader community | Simple risk display in cash terms |

Conclusion: Choosing Between Match-Trader vs cTrader

When it comes to Match-Trader vs cTrader, the decision isn’t about which platform is “better” overall – it’s about which one fits your trading goals.

- If you value automation, advanced charting, and scripting, cTrader is your match.

- If you’re focused on prop trading, funded challenges, or managing multiple accounts, Match-Trader is purpose-built for you.

Maven supports both platforms, so you’re free to choose based on how you trade. Want to learn how cTrader stacks up against MetaTrader 5? Read about it here.