MetaTrader vs cTrader: Which Is Better for a Prop Firm Trader?

Written by Emma on September 15, 2025.If you’ve just joined a prop firm or are about to take a challenge, you’ve probably wondered which trading platform to use: MetaTrader vs cTrader. They’re two of the most popular platforms in the industry, but which one suits your trading style best?

In this article, we’ll break down MetaTrader vs cTrader feature by feature so you can decide which platform fits your prop firm trading goals. You’ll learn:

- What MetaTrader and cTrader are

- How they differ in execution, charting, automation, user experience, and more

- Each platform’s unique strengths

- A clear verdict on which one makes the most sense for your trading style

MetaTrader vs cTrader: What Are These Platforms?

MetaTrader has been around for years, and most traders have used it at some point, especially MetaTrader 4 (MT4). Launched in 2005, MT4 was the standard during the early boom of retail forex trading. MetaTrader 5 (MT5) arrived in 2010, adding more timeframes and asset classes, including stocks, commodities, and futures.

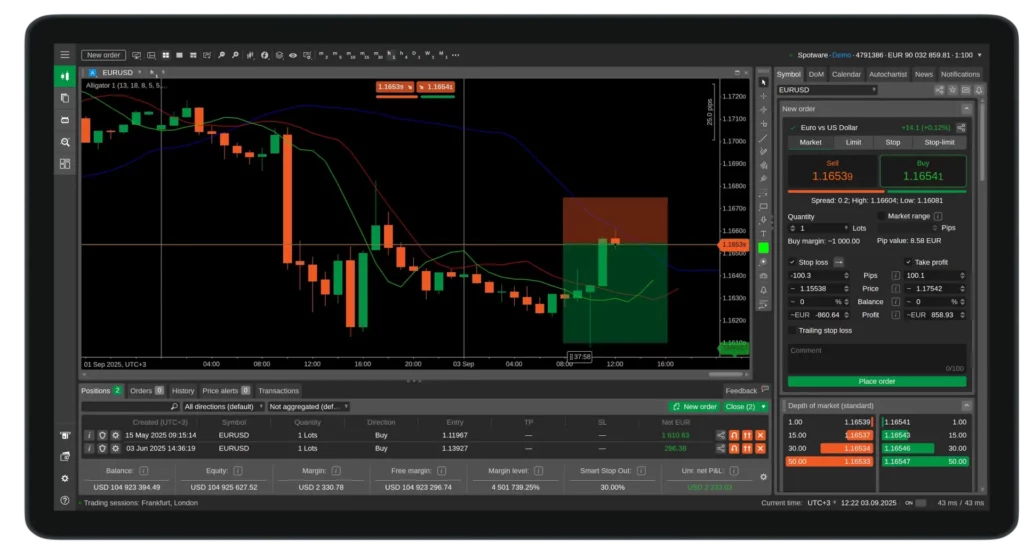

cTrader, on the other hand, is modern and built for traders who care about speed, performance, and design. Its interface is smooth, charts are sharp, and automation is built in via cAlgo, which runs on C#. From the moment you open cTrader, it feels like a proper desktop trading app. cTrader was built to give traders more control over their trading experience. It’s order execution is lightning-fast and automation comes built-in through a tool called cAlgo, which runs on C#.

MetaTrader vs cTrader: Feature Comparison

User Interface

The user interface is how you interact with the platform, including charts, menus, order windows, and buttons.

- MetaTrader: Familiar, but dated. Adjusting risk or lot size is manual, and chart tools are basic unless you add plugins.

- cTrader: Visual, fast, and intuitive. You can see stop loss and take profit in monetary terms and adjust orders directly on the chart.

| Feature | MetaTrader 5 (MT5) | cTrader |

| Dark Mode | Yes | Yes |

| App Languages | 22 | 23 |

| In-App User Guide | No | Yes |

| Multiple Chart View | No | Yes |

| Customizable Watchlists | No | Yes |

🏆 Winner: cTrader

MetaTrader vs cTrader Charting Tools

Charts are your workspace for spotting trading opportunities.

| Feature | MetaTrader | cTrader |

| Chart appearance | Functional but dated | Sleek and highly customizable |

| Drawing tools | Standard set | Extensive drawing tools available |

| Timeframe options | Standard (1 min to monthly) | Includes custom timeframes eg you can choose from a wider range of timeframes. |

| Multi-screen support | Limited | Supports multi-screen chart setups |

| Advanced visuals (heatmaps etc.) | Requires external plugins | Some advanced tools built-in or easier to access |

| Personalized chart view | Clunky | Simple and flexible |

🏆 Winner: cTrader

Order Execution

Execution speed and reliability matter, especially in volatile markets.

- MetaTrader: Supports market, limit, and pending orders, but speed depends on your broker.

- cTrader: Designed for fast, transparent execution with depth of market (DOM) visibility and partial fills.

| Order Execution | MetaTrader 5 (MT5) | cTrader |

| Types of Orders | Basic options available such as Market, Limit & Stop Orders | More options like Fill or Kill (FOK), Immediate or Cancel (IOC). |

| Slippage Control | Less control over price changes | You can set how much price can move when you set a “Market Range” order. |

| Partial Order Fills | Doesn’t always allow that | Can fill part of your trade if needed |

| Market Depth View | Not always available | Shows how many buyers and sellers exist using Depth Of Market. |

| Setting & Changing Orders | Less visual and more manual | Easy to drag and change on chart |

| How Trades Are Handled | Depends on the broker setup | Goes straight to the market (no middlemen) |

🏆 Winner: cTrader

MetaTrader vs cTrader Risk Management

Risk management tools are key for prop firm traders.

- MetaTrader: Displays stop loss/take profit in pips or price only; dollar risk must be calculated manually.

- cTrader: Dollar risk, reward-to-risk ratio, and position sizing are displayed automatically.

| Feature | MetaTrader 5 (MT5) | cTrader |

| Risk Display | Doesn’t show dollar risk by default | Shows dollar risk before you place a trade |

| SL/TP Input | Set in pips or price only | Set in pips, price, or dollar value |

| Reward-to-Risk Ratio | Not shown unless you use custom tools or plugins | Automatically shown when setting up a trade |

| Position Sizing Help | You need to calculate it yourself | Automatically adjusts position size based on your stop loss |

🏆 Winner: cTrader

Automation & Bots

This is also known as algo trading and it involves using scripts or bots to trade on behalf of traders.

- MetaTrader: Supports Expert Advisors (EAs) with a huge library and community.

- cTrader: Uses cBots in C#, smaller community but professional-grade tools.

| Feature | MetaTrader 5 (MT5) | cTrader |

| Automation Name | Expert Advisors (EAs) | cBots |

| Programming Language | MQL5 | C# |

| Marketplace Availability | Large public library of free and paid bots | Smaller, more professional-focused |

| Strategy Tester | Built-in | Built-in |

🏆 Winner: cTrader

MetaTrader vs cTrader Ease of Use

- MetaTrader: Very familiar; lots of tutorials online.

- cTrader: Cleaner, more visual, and beginner-friendly straight out of the box.

Mobile & Web Experience

- MetaTrader: Functional app, limited web access unless broker enables it.

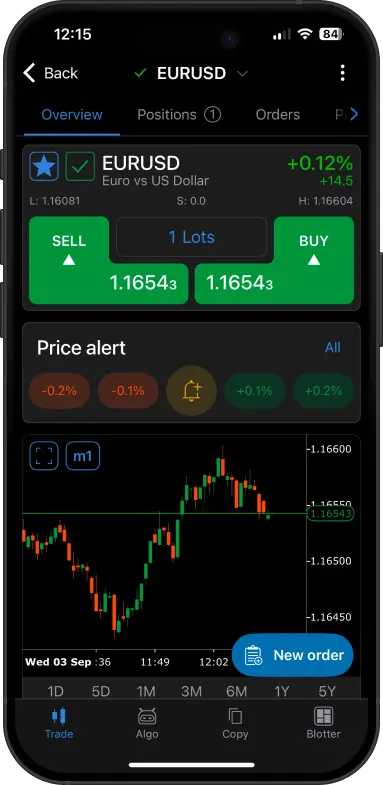

- cTrader: Smooth mobile and full-featured web app, syncing seamlessly across devices.

| Feature | MetaTrader 5 (MT5) | cTrader |

| Mobile App | Basic and functional, but outdated UI | Smooth, modern, easy to navigate |

| Web Version | Only available if broker sets it up | Full-featured, accessible from any browser |

| Cross-Device Sync | Limited | Seamless sync across desktop, web, and mobile |

| Visual Experience | Feels dated | Clean and responsive design on all screen sizes |

| Speed and Stability | Depends on broker setup | Fast and stable out of the box |

🏆 Winner: cTrader

MetaTrader vs cTrader Broker and Prop Firm Support

- MetaTrader: Supported by nearly all brokers and prop firms; common for funded account challenges.

- cTrader: Growing in popularity, but not as widely supported yet.

| Feature | MetaTrader 5 (MT5) | cTrader |

| Prop Firm Availability | Widely supported by almost all major prop firms | Limited support, but growing slowly |

| Broker Compatibility | Available with most brokers worldwide | Supported by fewer brokers |

| Default Platform for Challenges | Commonly used in funded account challenges | Rarely the default option |

| Popularity | Industry standard | More common among advanced or tech-focused traders |

| Getting Paid Out | Most payouts handled via MT4/MT5 platforms | Less common but supported by select prop firms |

🏆 Winner: MetaTrader

What Makes Each Platform Unique?

| Unique to MetaTrader 5 (MT5) | Unique to cTrader |

| Long-standing user base | Modern, sleek UI |

| Huge library of EAs, indicators | Built-in transparency: DOM, volume, slippage |

| Compatible with most brokers | Better charting tools out of the box |

| Popular among serious brokers | Ideal for beginner and professional traders |

Which Should You Use?

If you’re new to prop firm trading and want speed, clean charts, and beginner-friendly design, cTrader is a great choice.

If your prop firm only supports MetaTrader, or you want access to EAs and a huge library of plugins, MetaTrader may be more flexible.

Ultimately, understanding the differences between MetaTrader vs cTrader will help you pick the platform that fits your trading style and goals.

MetaTrader vs cTrader: Final Verdict

Both MetaTrader and cTrader are powerful platforms. MetaTrader is widely supported and great for custom tools and automation, while cTrader offers a faster, cleaner experience ideal for newer traders. If your prop firm allows it, try both and see which feels more natural – knowing your platform is the first step to trading success. At Maven, we help traders get set up on the right platform for their goals, whether you’re aiming for speed, automation, or a smoother trading experience.

Want to learn how cTrader stacks up against Match-Trader? Read about it here.