Trailing Drawdown in Prop Trading: What It Is & Why It Matters

MAVEN TRADING OPERATES A SIMULATED TRADING ENVIRONMENT THAT REPLICATES CERTAIN REGULATED FINANCIAL MARKETS BUT DOES NOT INVOLVE TRANSACTIONS IN OR SERVICES CONCERNING REGULATED FINANCIAL INSTRUMENTS.

MAVEN TRADING DOES NOT SUPPLY ANY REGULATED FINANCIAL SERVICES. MAVEN TRADING IS NOT REGULATED OR AUTHORIZED BY ANY FINANCIAL SERVICES REGULATOR IN ANY JURISDICTION.

By reading this article, you’ll understand key aspects of trailing drawdown:

- The difference between trailing drawdown and static drawdown in prop firm challenges.

- How trailing drawdown works.

- Types of trailing drawdown: End-of-Day (EOD) and Intraday.

- Why it matters for disciplined trading and risk management.

- 5 practical strategies to succeed: understand firm rules, use small lot sizes, lock in profits, avoid volatile sessions, and grow gradually.

Understanding Trailing Drawdown

There are two types of traders: those who understand trailing drawdown and those who don’t. This is because trailing drawdown is one of the most misunderstood risk management rules in prop firm challenges and one of the most brutal if you get it wrong.

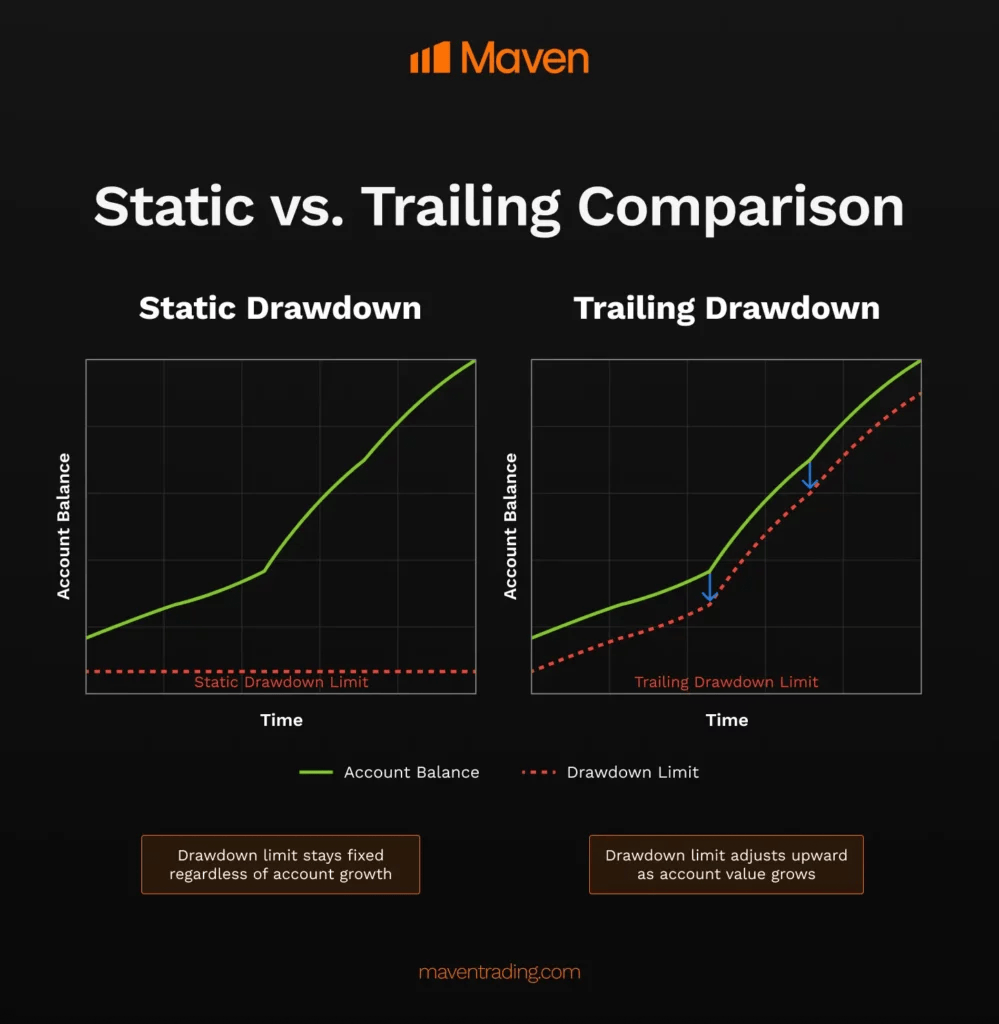

To understand trailing drawdown, we first need to cover static drawdown. Static drawdown is the fixed amount you’re allowed to lose before your account is breached. It stays in one place and doesn’t change, no matter how much you make or lose, it’s constant and unmoving.

For example, Maven’s 2-step accounts use a static drawdown, meaning the 8% overall drawdown limit stays fixed. So, on a $100,000 account, you’re allowed to lose up to $8,000 (i.e. your account must never drop below $92,000 at any point.)

Trailing drawdown, on the other hand, is different, it moves. As your account grows, the drawdown limit trails behind, not staying fixed like static drawdown.

What is Trailing Drawdown?

It is a rule used in prop firm challenges that limits how much you can lose as your account grows.

Picture this: You start with $10,000 in a trading challenge with a 10% overall drawdown (i.e. a trailing drawdown). This means you’re only allowed to lose $1,000.

Now, let’s say you made an additional $500 on your initial balance of $10,000 and grew your balance to $10,500 as a result. The drawdown limit moves up as well and now sits at $9,500. If your account ever drops below that $9,500 mark, even for a moment, you fail the challenge. As your balance climbs, the limit climbs too but once it moves up, it never moves back down.

Mathematically speaking, Trailing Drawdown = Highest balance you’ve reached – the amount you’re allowed to lose.

Example: You start with $10,000 balance and you’re only allowed to lose $1,000. Then your balance grows to $11,500:

$11,500 – $1,000 = $10,500.

That means if your account drops below $10,500 at any point, you fail the challenge.

This rule protects the firm and pushes traders to grow steadily without reckless drawdowns.

There are different types of trailing drawdowns, some popular ones are:

- End-of-Day (EOD) Trailing Drawdown: This only updates at the end of the trading day and is usually based on your profits from the trades you closed.

Example, you start with $10,000 and a $1,000 trailing drawdown, your limit is $9,000. By the end of the day your closed profit is $500, making your new total $10,500. Your overall drawdown now moves to $9,500 (which is 10% of your new balance). Note: If you don’t close the trade by the end of the day, it doesn’t count. - Intraday Trailing Drawdown: This updates in real-time and often uses your live equity, including unrealized profits.

Using the same $10,000 account as before: Let’s say you have a floating profit of $500 on your $10,000 account. Your drawdown limit moves up to $9,500. If the trade pulls back and your account value drops below $9,500 even if you’re still in overall profit you could fail the challenge. Maven uses this style of trailing drawdown, which is based on equity, not balance. That means the drawdown limit moves based on your highest floating profits even if you haven’t closed the trade yet.

Why Does It Matter?

Trailing drawdown forces you to trade with discipline. It punishes overleveraging, emotional swings, and poor risk management. Also, prop firms use it to weed out gamblers from consistent traders.

It’s not a disadvantage once you know how to use it. It can actually help you trade smarter and stay consistent as long as you follow the following key strategies.

5 Key Strategies Disciplined Prop Traders Use to Optimize Trailing Drawdown Rules

1. Understand Your Firm’s Rules

Not all prop firms calculate trailing drawdown the same way. Some calculate it based on your balance (closed trades only), while others use equity (including floating profits/losses).

For example, Maven’s instant funded account uses a trailing drawdown based on equity, not balance. This means the drawdown limit adjusts in real time as your account’s highest equity increases, including floating profits.

2. Avoid Big Lot Sizes Too Soon

Going aggressive early might push your trailing limit up before you’ve built any real cushion. If the market reverses, you risk violating the new drawdown level even if you were “in profit” just moments ago.

Start small. Trade with smaller lots until your account grows enough to handle more risk.

3. Lock In Profits Early

Don’t sit on large floating profits especially if the firm uses intraday. If your trailing drawdown rises based on equity and you don’t close the trade, any pullback could disqualify you.

Train yourself to secure wins. Think of it like saving your progress in a video game, if you don’t hit save and something goes wrong, you’re back to square one.

4. Withdraw from Volatile Sessions

Avoid trading during high-impact news events or periods of market chaos. Spikes can cause quick reversals that hurt your drawdown limit.

5. Build Gradually

Your goal is to keep your account strong and stay consistent. Instead of trying to hit home runs, aim for small, repeatable wins that compound over time.

This helps you manage risk and keeps your drawdown in sync with real growth. A slow grind upwards is better than one big move that gets you closer to your trailing limit.

Final Thoughts

Trailing drawdown is not your enemy, it’s a test. It rewards consistency, punishes recklessness, and separates real traders from lucky ones. If you want to pass a prop firm challenge, don’t just learn it. Master it.

You can start learning how to master a prop firm challenge by choosing the right challenge for you. Check out some of Maven’s featured challenges here.

- drawdown

- Maven Trading

- Prop Firm Education

PLEASE SEE THE MAVEN TRADING WEBSITE AND OUR CUSTOMER TERMS AND CONDITIONS FOR MORE DETAIL.

Related thoughts and opinions

Stay informed with our informative blog posts.