How Forex Liquidity and Trading Conditions Impact Your Trades

Written by Jon on August 25, 2025.In this article, we discuss Forex Liquidity and Trading Conditions and cover:

- What forex liquidity actually means

- Liquidity changes in December (holiday impact)

- Liquidity changes in August (summer slowdown)

- Liquidity during major news events

- Liquidity during rollover (5pm New York time)

- Liquidity during market opens and session overlaps

Let’s get into it!

Understanding Forex Liquidity and Trading Conditions

What Forex Liquidity Means

Have you ever been in a crowded market? Even if you haven’t, in a busy market, you have options. You ask for oranges, five hands go up. Prices stay low, and you don’t have to wait around.

Now imagine trying to buy oranges in that same market but at 3am from a single sleepy vendor who just woke up. He’s got two orangess left, and he knows you have no choice. You pay more. You wait longer and sometimes, the price could jump up giving you no choice but to buy the orange at a higher price. That’s similar to how liquidity works in trading.

Forex liquidity is just like what happens in that crowded market; it’s about how easy it is to get in and out of a trade without fuss. When there are a lot of buyers and sellers available (like all those fruit vendors), you can buy or sell quickly, at fair prices, without pushing the cost around.

🎥 Watch this video explanation: What Is Liquidity? – it breaks down what liquidity is, how liquidity works, and why it matters in trading.

How Liquidity Affects Trading

Technically speaking, it is how easily a currency pair can be bought or sold without causing significant changes in its price. In highly liquid conditions, there’s a deep pool of buyers and sellers across multiple price levels, which keeps spreads tight and execution smooth even for large orders, but when liquidity is low, it means there are fewer participants, which leads to wider spreads, increased slippage, and greater price volatility.

Common Currency Pairs with High and Low Liquidity

Some currency pairs known for their high liquidity are:

- EUR/USD,

- USD/JPY

- GBPUSD

- USDCHF

- USDCAD

- NZDUSD

| On the other hand, less common currency pairs or trades made during off-hours can have low liquidity, which leads to bigger price changes and wider spreads. |

How Liquidity Changes Over Time

Liquidity isn’t constant, it changes with the time of day, the season, and even global events. Some periods see active markets where orders fill instantly, others feel like walking into an empty store, there’s hardly anyone to trade with, so prices can jump more easily. December is a perfect example of this shift.

December Forex Liquidity and Trading Conditions

The end of the year feels different for most people around the world. Whether or not you celebrate the holidays, the season brings a shift in routine. In many places, it’s colder, work slows down, and people take time off. Trading is no different, December tends to be one of the slowest months in the trading calendar, especially in the second half of the month. Some of the reasons for this change as noted by brokers are:

- Lower trading volume as banks and institutions close for holidays.

- Many retail traders close positions early since most brokers shut down or operate on limited hours on December 25th, 26th, and January 1st.

- Fund managers often stop taking trades to do year-end portfolio adjustments and profit-taking, which influences currency flows.

- Holiday periods can delay important economic data releases, affecting market sentiment.

This drop in participation means lower Forex Liquidity and Trading Conditions, increasing the risk of wider spreads and slippage.

However, it’s not slow all month. The first two weeks of December can still see moves, especially if there are major economic releases or central bank decisions, but after mid-month, liquidity typically falls sharply as the market winds down. As stated by another broker, FBS, it’s important to follow tips that would protect you if you would like to trade during this period.

August Forex Liquidity and Trading Conditions

August is known as a summer month often associated with hot weather and holidays.

August is often one of the quietest months in the forex market. Many other trading resources agree with this, including the Babypips forum where some traders point out that August often sees low liquidity for a few key reasons such as:

- Many big players, like bank traders and hedge fund managers, are on summer holiday.

- Trading desks in Europe slow down due to the August vacation season, which overlaps with lighter summer trading in the US.

- Some institutional traders and funds deliberately avoid taking new large positions before September, preferring to wait for full market participation.

| Think of it like playing football with some of the players missing. The game is still happening, but there are empty spaces, so the ball can roll freely without much challenge. |

Purple-Trading, a broker founded by a group of Czech and Slovak trading enthusiasts, however, added that surprises can still happen unexpected economic news or political events can create short bursts of volatility. But these moves don’t usually last long before the market goes quiet again.

Key takeaways:

- Expect slower movement for most of August.

- News can cause short-lived spikes, but they fade quickly.

- Plan for a calmer market where forex liquidity and trading conditions tend to shift, and be patient waiting for good setups.

Liquidity During News Events

You’ve probably seen this before, maybe noticed on X (formerly Twitter) how someone warned, “Don’t trade right before the news”. That’s because just before a big news event, spreads often blow up. For example, you might normally see the EUR/USD spread at around 1 or 2 pips but right before a major release, it can suddenly jump to 15 or even 20 pips.

So how does this affect liquidity? A news event can both add and subtract from liquidity, it just happens at different times.

Before the news:

- Liquidity drops because many traders and big institutions pull their orders to avoid being on the wrong side of a sudden move.

- This is why spreads often widen a few minutes before big announcements.

Right after the news:

- Liquidity can still be low in the first seconds because the market is digesting the data.

- Then, as traders start reacting and placing new orders, liquidity often increases but it’s usually paired with extreme volatility.

So it’s like the market “holds its breath” before the news (low liquidity), then takes a big gulp of air after (more liquidity).

How Rollover Affects Forex Liquidity and Trading Conditions

The daily rollover (when one trading day ends and the next begins, around 5 p.m. New York time) is another low-liquidity period. In a rollover, your broker automatically closes your position at the end of the trading day and re-enters the trade at the new open rate. Here are some things you should know:

- During this time, banks and large liquidity providers are often closed or winding down their operations, so fewer people are placing trades.

- With fewer participants, the market becomes illiquid, this happens simply because there’s less competition for prices and more risk for those still trading.

In real life, this means if you place an order close to rollover, you might get a much worse price than expected, or your trade might slip or only partially fill. So it’s smarter to avoid placing big trades right at rollover and adjust your risk settings if you must trade during it.

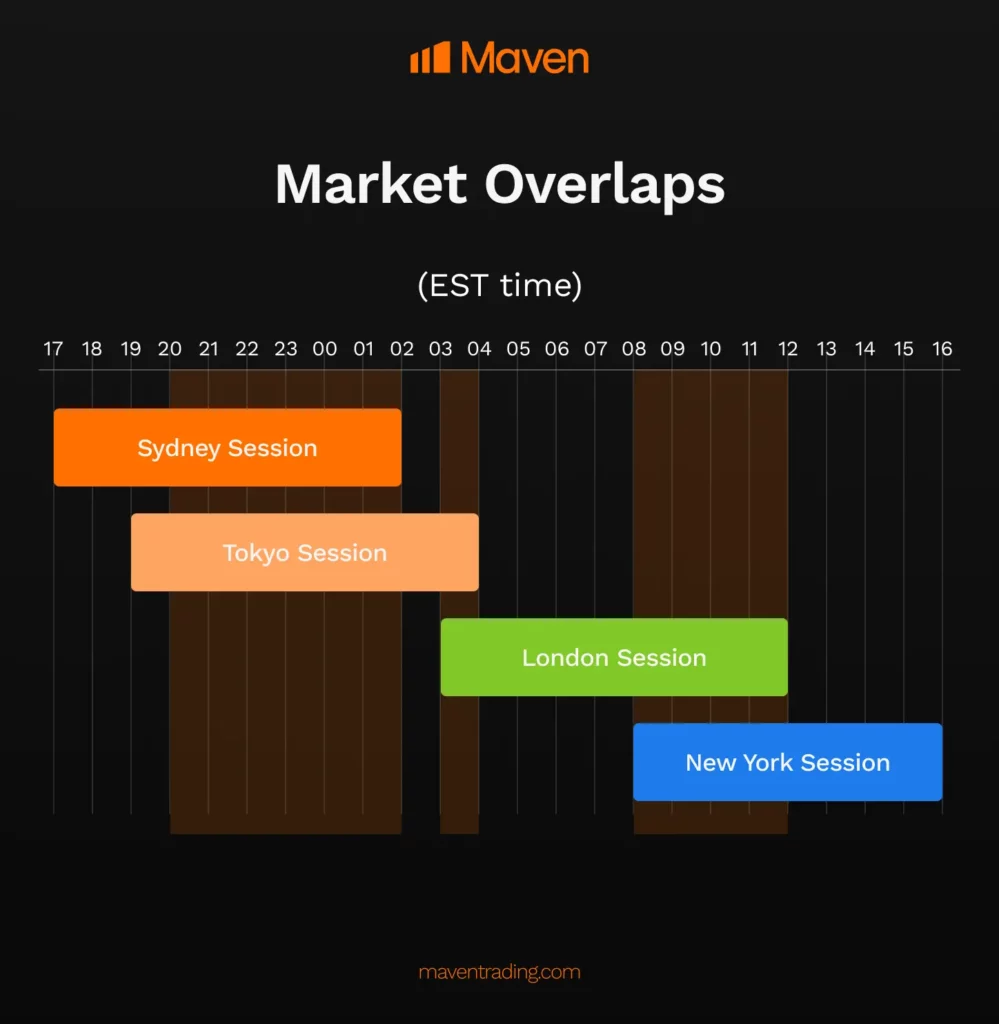

Forex Liquidity and Trading Conditions at Market Opens and Overlaps

Market opens are moments when a major financial center starts its trading day. It usually brings a burst of liquidity and volatility because fresh orders hit the market. These moments are: Sydney (5pm ET), Tokyo (7pm ET), London (3am ET), and New York (8am ET).

These sessions become more liquid when they overlap. An overlap happens when more than one session is open at the same time. For example:

- London/New York overlap (8am–12pm ET): Very high liquidity.

- Tokyo/London overlap (3am–4am ET): Moderate liquidity.

- Sydney-Tokyo (7:00pm-2:00am ET): Mild liquidity.

In general, liquidity peaks when markets overlap. You should therefore plan to trade large orders during the busiest sessions, and be wary of spikes in spread or slippage during more isolated hours.

Final Words

Forex liquidity and trading conditions are significant because they shape every trade you take. Whether it’s December’s holiday slowdown, August’s summer lull, the chaos around news releases or rollovers, knowing when liquidity is high or low helps you avoid wide spreads. That’s where a trusted firm like Maven makes a difference with tight spreads and reliable execution, even in tricky conditions. Get yourself a Maven account today.