Maximum Risk per Trade Idea

Written by Jon on May 16, 2025.What is a Maximum Risk per Trade Idea?

The term maximum risk per trade idea might sound intimidating, but it is a simple term used by trading firms to help you manage losses. In this guide, we’ll break down max risk per trade idea step-by-step using examples.

Key Assumptions

Let’s set up our scenario:

- You have a $10,000 trading account.

- Your max risk per trade idea is 1%, meaning you can lose no more than $100 on a single trade idea.

Why $100?

1% of $10,000 = $100. This is the most you can lose on one trade idea.

What is a Trade Idea?

A trade idea refers to all positions opened for a single currency pair (or asset, like gold, represented as XAUUSD) during a period when at least one position remains open. The trade idea begins when you open the first position and ends when all positions for that pair are closed.

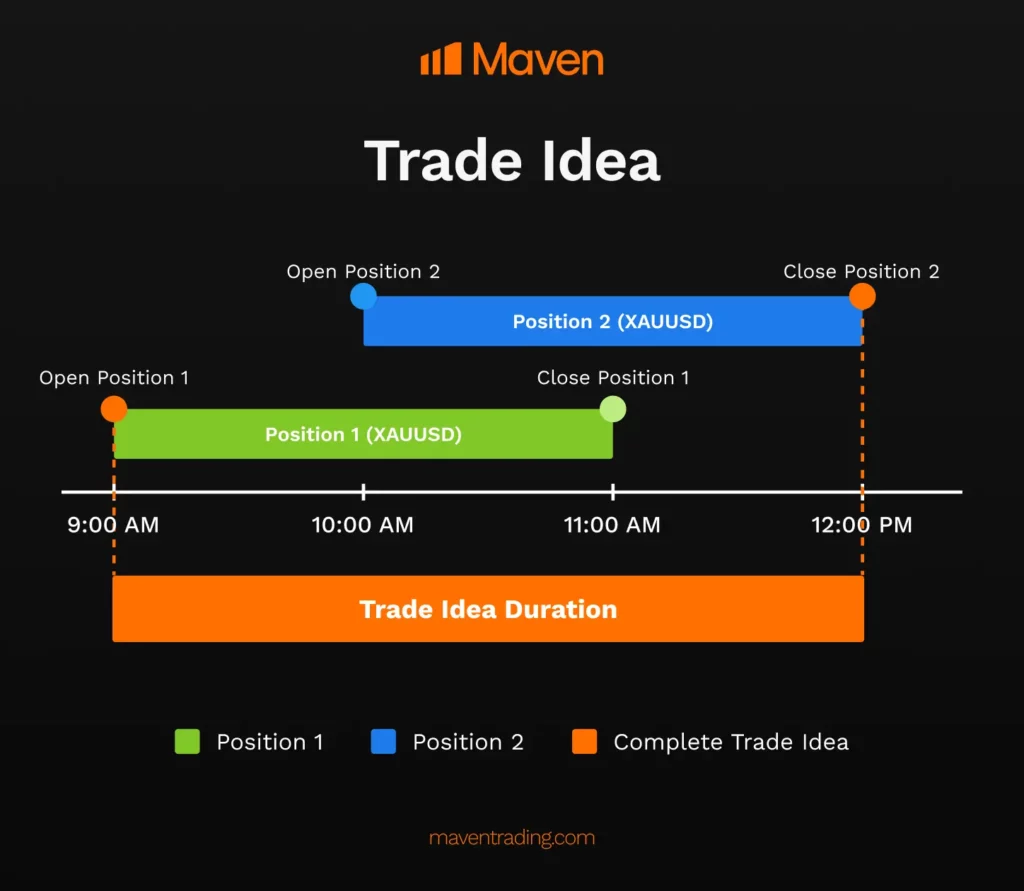

Example of a Single Trade Idea

- You open a position in XAUUSD (gold) at 9:00 AM.

- You open a second XAUUSD position at 10:00 AM.

- You close the first position at 11:00 AM.

- You close the second position at 12:00 PM.

This is one trade idea. Why? Because the positions overlapped (both were open simultaneously at some point). The trade idea started at 9:00 AM and ended at 12:00 PM. Ultimately, the idea ends once all positions of those pairs are closed.

What’s Not a Singular Trade Idea?

So, when do you have multiple trade ideas? Well, a trade idea requires overlapping positions and is specific to one currency pair. Let’s examine two scenarios where

Scenario 1: No Overlap

- You open a position in XAUUSD at 9:00 AM.

- You close it at 10:00 AM.

- You open a second XAUUSD position at 11:00 AM.

- You close it at 12:00 PM.

This scenario outlines two trade ideas. Why? There was no overlap; the first position closed before the second opened. 1 and 2 are one trade idea, and 3 and 4 are the second trade idea.

Scenario 2: Different Pairs

- You open a position in XAUUSD at 9:00 AM.

- You open a position in GBPUSD (British pound vs. US dollar) at 9:00 AM.

- You close both positions at 10:00 AM.

This is two trade ideas. Why? Each currency pair (XAUUSD and GBPUSD) is treated as a separate trade idea, even if the positions are open at the same time.

Putting it All Together

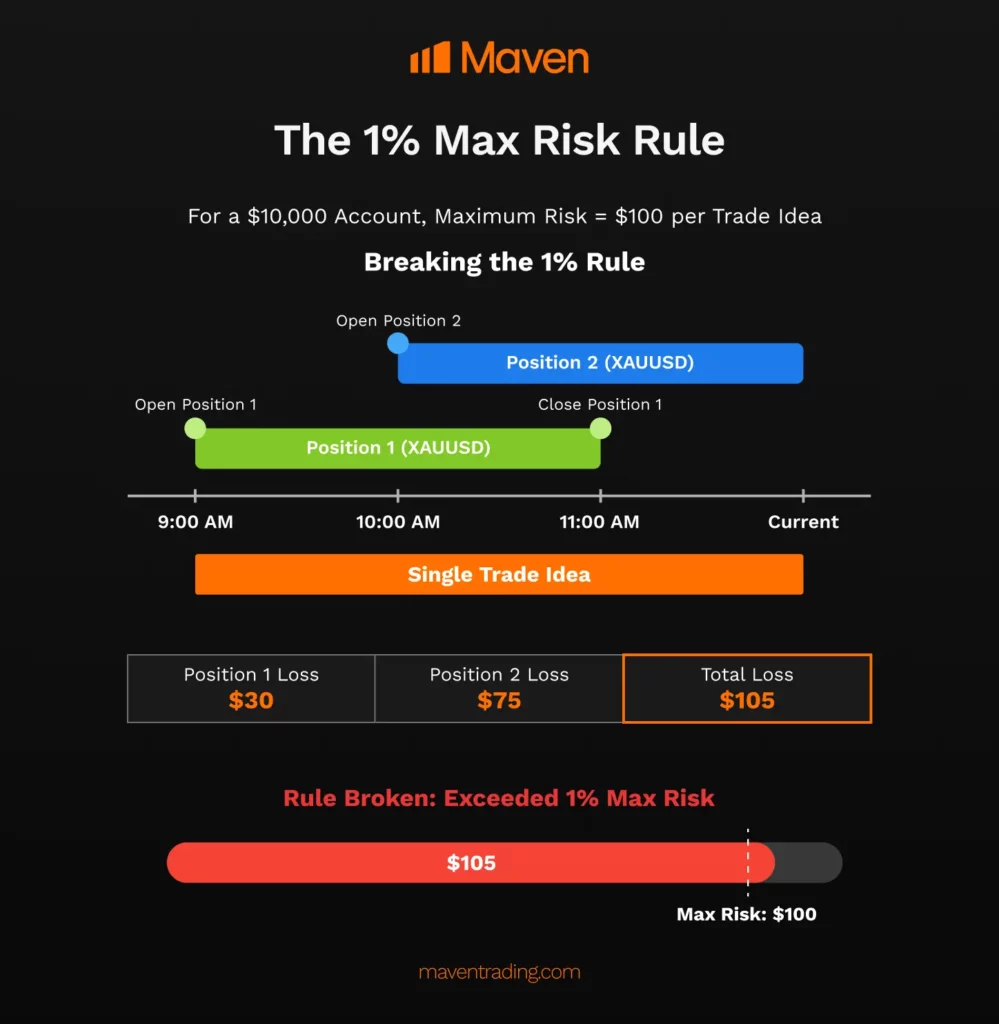

Now let’s apply the 1% max risk rule using our example from the beginning, the $10,000 account. Remember, you cannot lose more than $100 on a single trade idea.

Breaking the 1% Rule

- You open a first XAUUSD position at 9:00 AM.

- You open a second XAUUSD position at 10:00 AM.

- At 11:00 AM, you close the first position with a $30 loss.

- The second position suffers a $75 loss and is still open.

Total loss: $30 + $75 = $105. This is one trade idea because the positions overlapped. You’ve now exceeded the 1% max risk ($100) by $5, breaking the rule.

Staying Within the 1% Rule

To avoid exceeding the maximum risk:

- Monitor your losses: Track the total loss across all open positions for a single currency pair.

- Close positions early: If your combined losses on a trade idea approach 1% (in this scenario), close all positions for that pair. Once closed, you can open a new position, which starts a fresh trade idea with a new $100 risk limit.

Tips to Manage Max Risk Per Trade Idea

To further help you succeed, here are actionable tips:

- Close Positions Early: Close positions before losses exceed the maximum risk per trade idea.

- Track overlaps: Be mindful of when positions for the same pair overlap, as they count as one trade idea.

- Understand your pairs: Familiarize yourself with the assets you’re trading (e.g., XAUUSD is gold, GBPUSD is pound vs. dollar) to avoid confusion.

- Practice discipline: Consistently stick to the 1% rule to protect your account and foster long-term trading success.

Why It Matters

Ultimately, the maximum risk per trade idea rule is a cornerstone of risk management. By limiting losses to 1% per trade idea, you shield your account from large drawdowns. As a result, you gain more opportunities to trade and grow your portfolio over time.

Ready to put this into practice? Start small, experiment with a demo account, and keep the 1% rule front and center. Happy trading!